In a move to better regulate local P2P lending space, Indonesian financial services regulator OJK has reportedly called in P2P lending startups to a meeting today, and asked them to suspend operating by midnight, if they’re not yet registered with the authorities.

Company registration is the first step towards getting the permanent business license required to operate a P2P platform in Indonesia long-term.

The rumour was first spread on a WeChat public account associated with Momentum Works (link in Chinese), and a source with knowledge of the matter confirmed with KrASIA that OJK indeed made that demand. The WeChat post adds that OJK authorities said companies can resume their work once they have entered the licensing process.

According to our source, there are more than a hundred P2P operators in Indonesia that haven’t yet even registered their companies with OJK. Those who have registered but are still waiting for their permanent license are not affected.

Many of the new players are from China, where a recent regulatory crackdown on online lending had caused companies to seek fortunes overseas – and many small-scale investors to lose their savings.

Governing bodies like OJK and the Indonesian Central Bank, who oversee regulations in financial services and payments systems, are becoming stricter in dealing with fintech companies. Bank Indonesia issued a number of new regulations in the past months, and also called for stricter enforcement, apparently determined not to repeat China’s same boom and bust cycle in P2P space.

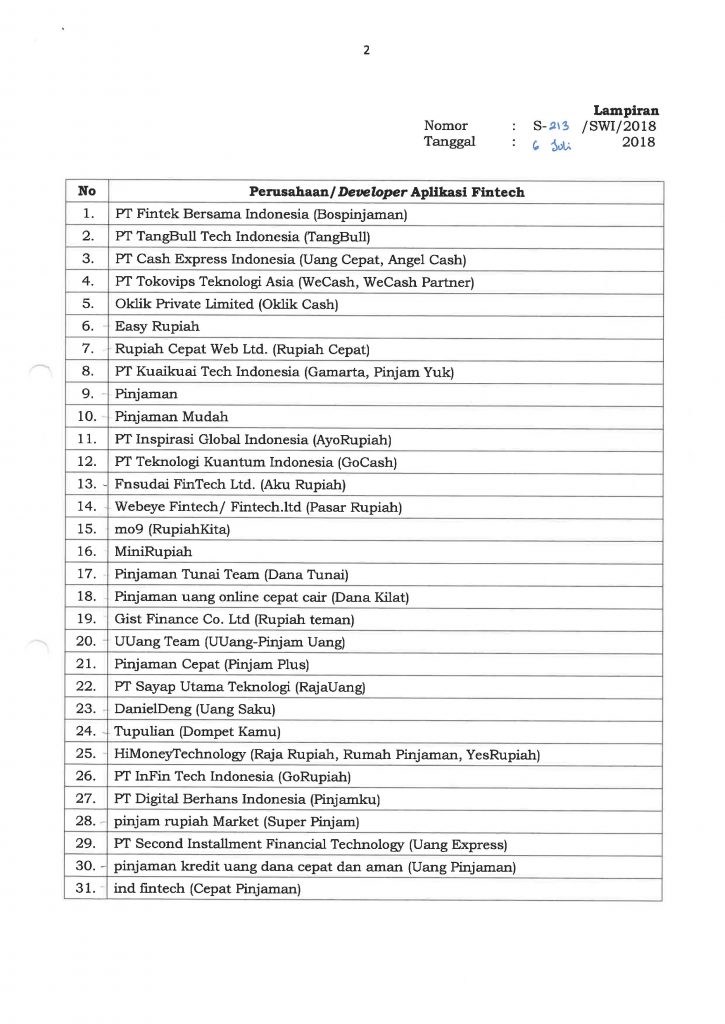

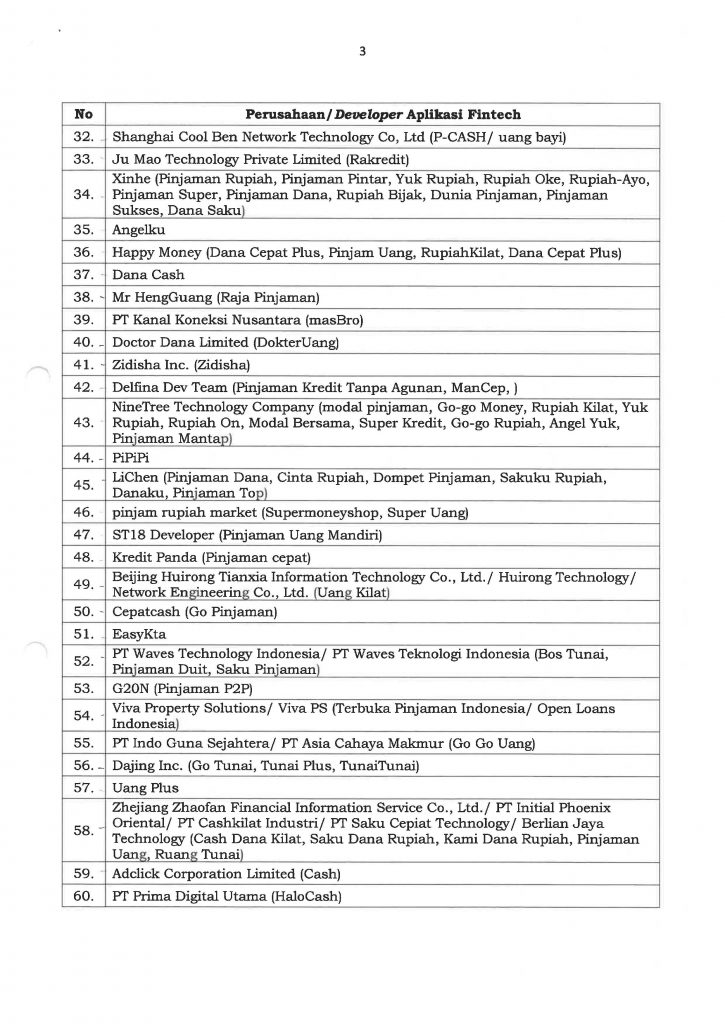

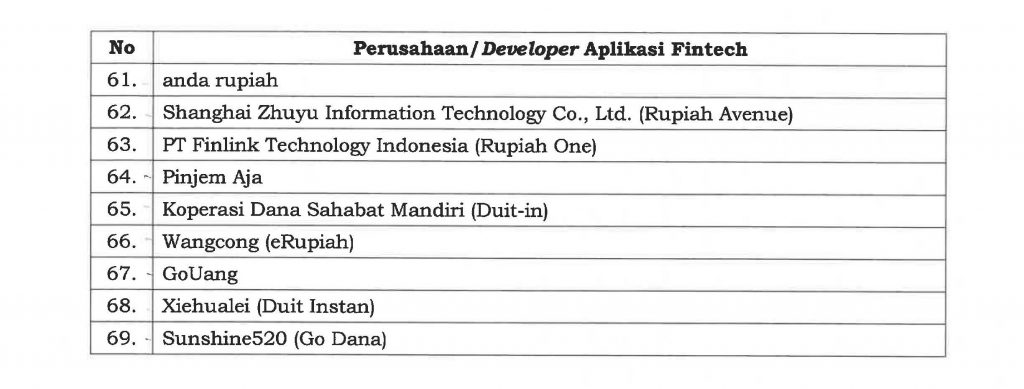

(The story has been updated to include a list of the companies being summoned by OJK today.)

Editor: Ben Jiang